North Dakota rolls out low-interest loans to aid federal workers during shutdown

BISMARCK, N.D. (North Dakota Monitor) — North Dakota is offering an estimated 9,200 federal workers a lifeline through a loan program approved Wednesday to help military and other families affected by the government shutdown.

The North Dakota Industrial Commission approved the Furloughed Federal Employee Relief Program, which leverages the state-owned Bank of North Dakota to offer low-interest loans to cover lost wages. The short-term loans can be repaid after the federal government reopens and employees receive back pay.

Gov. Kelly Armstrong, who recently served in Congress, said the idea for the relief program started in his head in 2018 when he was flying to Washington, D.C., during a shutdown and was “read the riot act” by a Transportation Security Administration agent who was working without pay.

“And rightfully so. We ask those guys to go to work every single day in the middle of these shutdowns, regardless if they’re getting paid or not,” said Armstrong, a Republican who chairs the three-member Industrial Commission.

Federal employees who aren’t getting paid will be able to apply for 2% loans through a North Dakota bank or credit union for up to three months of their take-home pay. Applications will be accepted starting Friday. Information on how to apply is available at the Bank of North Dakota’s website. Borrowers will have five months to repay the loans.

Industrial Commission officials estimate the total number of eligible North Dakota federal employees, including those stationed on two Air Force bases, is about 9,200 people.

“The ones that are going to work every day protecting our country, the ones that go to work every day making sure we get on airplanes, are actually the people most likely to be living paycheck to paycheck,” Armstrong said.

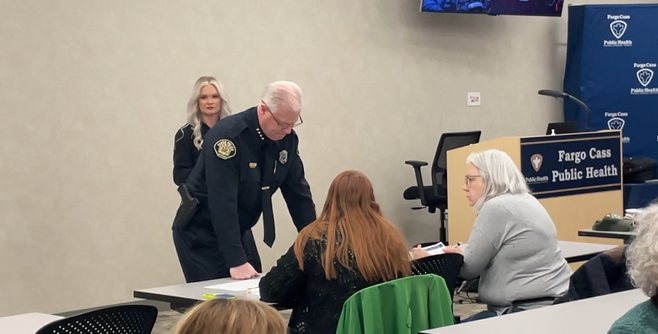

Gov. Kelly Armstrong, center, speaks to Don Morgan, left, president of the Bank of North Dakota, during a special meeting of the Industrial Commission with Agriculture Commissioner Doug Goehring, center-left, and Attorney General Drew Wrigley, right, on Oct. 8, 2025. (Photo by Michael Achterling/North Dakota Monitor)

Grand Forks Mayor Brandon Bochenski, who participated in the announcement of the program, said his city is home to a lot of federal workers in addition to those at the Grand Forks Air Force Base.

“This is really going to help the rank and file,” Bochenski said. “Grand Forks is so grateful, and this is truly North Dakota at its finest.”

Rick Clayburgh, president of the North Dakota Bankers Association, encouraged federal employees to reach out to their local banks. The program is also available to new customers of North Dakota banks.

Don Morgan, president and CEO of the Bank of North Dakota, said the program is modeled after disaster relief programs the bank has done in the past. The Bank of North Dakota will buy the loans and pay each lender a service fee of $250.

The federal government shutdown entered its eighth day on Wednesday with neither Republican or Democrat funding plans receiving the 60 votes necessary to advance. The nonpartisan Congressional Budget Office projected 750,000 federal workers would be furloughed during the shutdown.

Phil Davis, Workforce Services director for North Dakota Job Service, said as of Friday, 10 federal employees had filed for unemployment since the start of the shutdown.

He said federal employees may be holding back on filing because the unemployment benefits would have to be repaid if the workers are awarded back pay.

President Donald Trump floated the idea this week that furloughed employees would not be entitled to receive back pay after the government shutdown ends.

The North Dakota loans do not require collateral, but are guaranteed by the back pay owed to federal workers.

Armstrong said there is a law that guarantees the back pay of furloughed federal employees, noting he voted to support it in 2019 as a member of Congress.

“The law says they get it,” he said. “There will be a tremendous amount of bipartisan support to protect the law that passed.”

North Dakota Monitor reporter Michael Achterling can be reached at machterling@northdakotamonitor.com.

North Dakota Monitor Editor Amy Dalrymple can be reached at adalrymple@northdakotamonitor.com.