North Dakotans face steep rise in health insurance without federal tax credits, commissioner warns

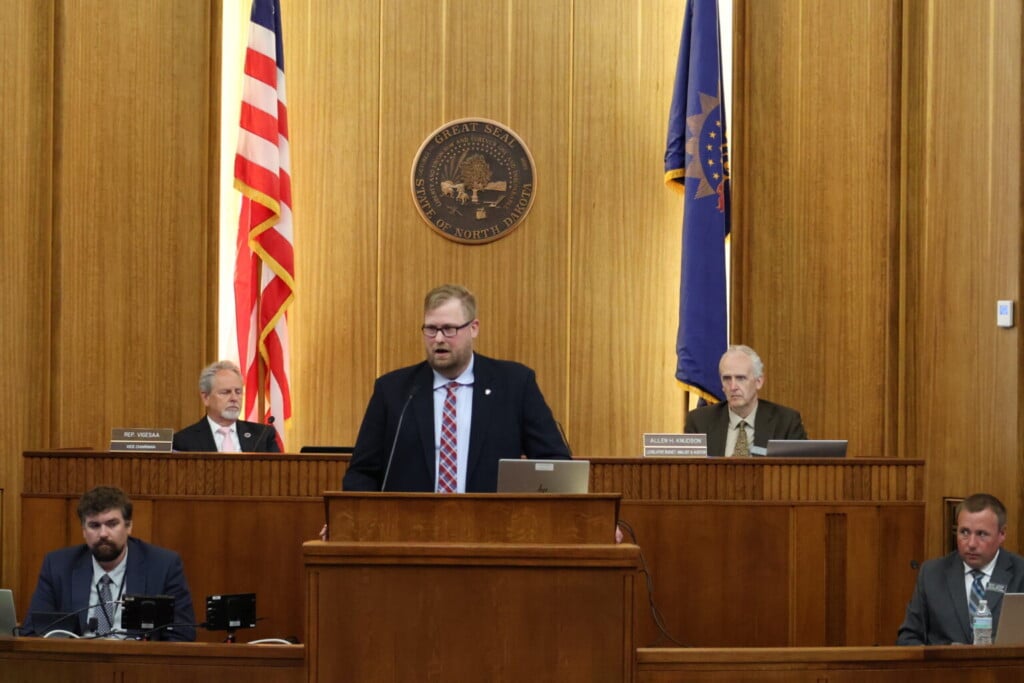

BISMARCK, N.D. (North Dakota Monitor) — North Dakota Insurance Commissioner Jon Godfread is sounding the alarm on the significant increase to health insurance facing tens of thousands of North Dakotans if the federal government doesn’t renew tax credits by the end of the year.

Unless the federal government takes action, premiums may rise between $378 and $3,735 in 2026, depending on a person’s income level, according to Kaiser Family Foundation data cited by the Insurance and Securities Department.

“In some cases it could be double, triple or even quadruple what you paid last year,” said Godfread, a Republican.

He expects the sharply increasing premiums to affect approximately 30,000 North Dakotans. As many as 10,000 may choose to go uninsured instead, based on third-party analyses Godfread has reviewed.

Godfread isn’t the only one concerned about the looming tax credit expiration. The prospect of more people becoming uninsured in a few months has the American Cancer Society Cancer Action Network among those calling for immediate action.

“These tax credits are incredibly important for individuals that are undergoing cancer treatments or are in need of basic health care, health insurance coverage,” said David Benson, senior campaigns manager for the organization.

Losing affordable health insurance also affects those who are seeking preventive screenings to detect cancer earlier, Benson said.

The state government can’t do much to help. The enhanced tax credits are a federal program. Godfread said eligibility for the credits was expanded during the COVID-19 pandemic and made it possible for a lot of people to gain access to health insurance.

“During that expansion we saw a number of farmers, ranchers, small business owners be able to qualify for a subsidy and then also able to access health insurance, which we think is a very good thing,” Godfread said.

Part of the problem is timing. The enhanced tax credits expire at the end of the year. But open enrollment, the two-month period where people have the opportunity to purchase a health insurance plan, begins in two weeks on Nov. 1.

Godfread worries the higher cost of insurance plans may drive consumers away from the marketplace even if the subsidy is later renewed by Congress before the end of the year.

“I’ll take any extension at any time over no extension,” Godfread said. “But I think what it could do is cause some confusion. If individuals go in and shop and they see this large increase, they may not come back and shop again if Congress acts and extends these subsidies.”

He’s no longer optimistic Congress will take action before Nov. 1, though Godfread is holding out hope the tax credits will be renewed before they expire on Dec. 31.

If policy makers want to end the tax credits, which he said were meant to be temporary during the pandemic, they have to create a “glide path” to minimize the impact on consumers and then have a real discussion about how to make health care more affordable, the insurance commissioner said.

“Insurance is merely an indicator of what services that you’re covering,” Godfread said. “So you can’t really have a meaningful discussion on ‘how do we bring down the cost of health insurance?’ without having a meaningful discussion on ‘how do you bring down the cost of health care services?’ So that would be an absolutely critical component.”

But the first step in Godfread’s mind is renewing the enhanced tax credits so consumers don’t face significantly higher costs and potentially have to go uninsured in 2026. Then Congress can begin looking for a long-term solution.

“The challenge is the system is what it is right now and there’s incentive to maintain the status quo and it’s the consumer who is being left out in the cold,” Godfread said. “I’m hopeful that this will spur that conversation.”

The federal government is in the midst of an ongoing shutdown in part because Senate Democrats have thus far refused to vote for a stopgap spending bill to fund the government without renewing the enhanced tax credits for health insurance plans at the same time.

Rep. Julie Fedorchak, R-N.D., has said the two issues are unconnected and should be discussed separately.

“This issue does need to be addressed, and it will be addressed,” Fedorchak said in an interview Wednesday with NewsNation. “But I think it’s also very important to recognize that premiums have been skyrocketing, even with these premium tax credits and the enhanced premium tax credits.”

Sen. Kevin Cramer, R-N.D., has said Democrats’ stand has shut down the federal government in order to “score political points.”

“These major health care policy changes Senate Democrats are demanding should be negotiated through the legislative process, not a short-term continuing resolution,” Cramer said in a statement on Sept. 30, the last day the government was open. “Their wish list of demands is not serious and is an act of extortion.”

Benson said these tax credits have led to record enrollments in marketplace insurance plans and have been instrumental in helping thousands of North Dakotans obtain “affordable, comprehensive coverage to be able to prevent, detect and treat cancer.”

“We are urging Congress to act quickly in finding a solution to extend these tax credits,” Benson said.

Health care costs in North Dakota, already among the highest in the nation, continue to rise. That’s a big reason why the “base rate” of insurance plans in the state is going up next year, with or without federal action.

The cost of individual health plans will increase by an average of 23.09% for Medica Health Plan, 8.3% for Blue Cross Blue Shield of North Dakota and 5.12% for Sanford Health Plan as a result of recent base rate increases Godfread’s office has approved for 2026. Small group market health plans will also rise by an average of 8.29% for UnitedHealthcare Insurance Co., 6.3% for Blue Cross Blue Shield of North Dakota, 3.91% for Sanford Health Plan and 7.89% for Medica Insurance Company.

“The cost of receiving health care in the state is continuing to rise,” Godfread said. “We have to do something to get our health care costs under control. North Dakota is a very high cost state to receive health care.”

North Dakota Monitor reporter Jacob Orledge can be reached at jorledge@northdakotamonitor.com.