Poll: Inflation dents North Dakota holiday spending spirit

BISMARCK, N.D. (North Dakota News Cooperative) — Inflation is hitting North Dakotans on a daily basis and impacting holiday spending, data from the latest North Dakota Poll shows.

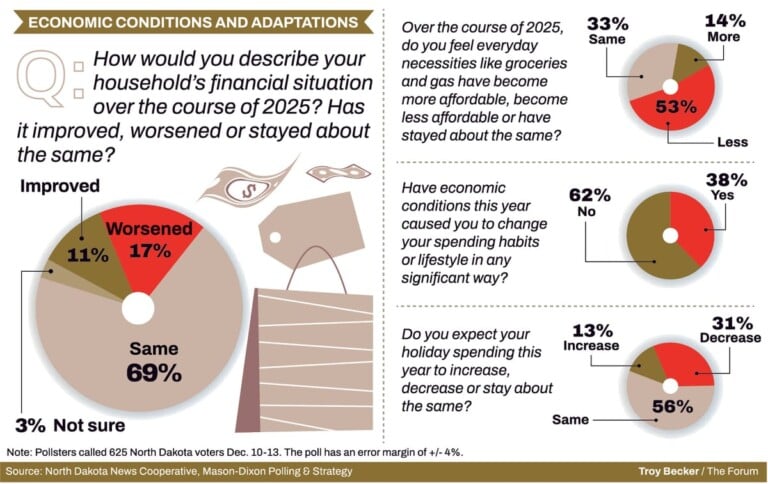

A total of 53% of respondents said everyday necessities like groceries and gas have become less affordable over the past year.

The impact is affecting some holiday spending, with 31% of respondents saying they planned to decrease holiday spending this year.

“The survey reinforces what North Dakotans are experiencing daily – persistent inflation is putting pressure on both households and employers,” said Arik Spencer, president and CEO of the Greater North Dakota Chamber.

“North Dakota businesses have absorbed higher input, labor, and regulatory costs for as long as possible while working to stay competitive,” Spencer said. “Eventually, some of those increases do reach consumers, and that reality is reflected in the poll.”

A primary influence of this is concern about how tariffs and trade policy impact food prices, jobs and the economy, with 56% of those polled saying they had either a little or a lot of worry over those impacts.

“The poll shows that North Dakota consumers are feeling the pinch from higher prices, that are at least partially the result of tariffs.” said John Bitzan, Menard Family Director of the Sheila and Robert Challey Institute for Global Innovation and Growth at North Dakota State University.

“While some retailers have been able to do things like buying inventories early and earning smaller margins in order to pass on less of the tariff costs to consumers, these options dwindle the longer the tariffs are in place,” Bitzan said. “I think people are finally seeing the price increases and are worried that these price increases will become even bigger over time.”

Bitzan said concern citizens have about tariffs affecting agriculture shows that people understand how important agriculture is to the North Dakota economy.

Rocky Schneider, executive director of the Downtown Community Partnership in Fargo, said there’s been a definite downturn in consumer spending and that’s reflected in sales tax data and day to day traffic to businesses.

One big impact for business in the Fargo area, he said, was the large decrease in the number of Canadian visitors, as well as lack of larger scale investments and a slow market for business creation.

A delayed jobs report from the U.S. Labor Department on Dec. 16 indicated the unemployment rate rose to 4.6 percent nationally, a figure not seen since 2021.

Overall, however, 62% of North Dakotans said they have not changed spending habits or lifestyle in a significant way.

“I think people are still spending,” Schneider said. “We haven’t stopped being good consumers.”

And in good news for local businesses, 51% of respondents said they always try to shop local and support North Dakota businesses over the 24% who hunt for the “best deal.”

Schneider said some of this was reflected during a recent “Small Business Saturday” just after Thanksgiving where he said some local retailers reported record numbers.

“I think when people do go out and spend money, they still understand that shopping locally is incredibly important and meaningful to the community,” Schneider said.

Kate Herzog, chief operating officer of Downtowners Bismarck, had similar remarks, and that visitor numbers in downtown Bismarck have been steady to slightly higher. A food truck event and the Bismarck Street Fair in September were both well attended, she said.

“The poll shows that things are less affordable over the course of this year,” Herzog said. “I would say that is an accurate representation of what we are hearing.”

Herzog said value concerns among lower income and lower middle-income earners are probably impacting the numbers.

“Spending really hinges on where you fall economically,” she said. “Our visit numbers are still up over last year, but people are being more cognizant of how they’re spending money, particularly if they’re feeling a pinch somewhere else.”

Spencer said there’s a natural selectiveness when it comes to spending as the cost of essentials rises.

“That pullback, particularly on discretionary items, has broader economic implications,” Spencer said. “It affects local businesses first and can slow economic momentum if inflation remains elevated for an extended period.”

The North Dakota Poll was conducted by Mason-Dixon Polling & Strategy, Inc. of Jacksonville, Florida from Dec. 10-13 2025. A total of 625 North Dakota adult residents were interviewed statewide by telephone.

The North Dakota Poll, sponsored by the North Dakota News Cooperative, is the only regular, non-partisan statewide survey of eligible North Dakota voters and consumers.