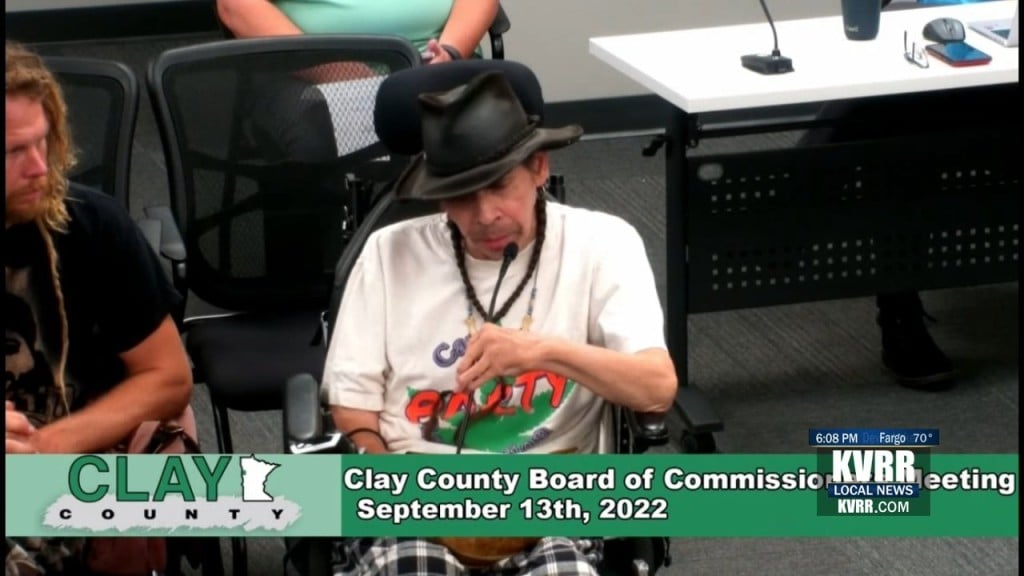

Blind Moorhead vet confused, frustrated about home ownership status

MOORHEAD, Minn. (KVRR) — A frustrated Moorhead veteran appears before the Clay County Commission about the status of his home ownership. Gulf War Veteran Kevin Shores is in the middle of a property tax dispute where he received letters from the County’s Auditor’s Office informing him about missing deadlines for delinquent taxes. The state of Minnesota seized his home in…